All Categories

Featured

Table of Contents

Choosing to purchase the real estate market, supplies, or various other standard kinds of possessions is prudent. When making a decision whether you need to spend in accredited financier chances, you ought to balance the compromise you make in between higher-reward potential with the lack of coverage needs or governing openness. It should be claimed that exclusive positionings require higher levels of threat and can on a regular basis stand for illiquid financial investments.

Especially, absolutely nothing here must be interpreted to state or imply that past outcomes are an indicator of future efficiency neither need to it be translated that FINRA, the SEC or any other safeties regulatory authority approves of any one of these safety and securities. Furthermore, when assessing private positionings from sponsors or companies providing them to recognized investors, they can offer no guarantees expressed or implied as to accuracy, completeness, or results obtained from any information provided in their discussions or presentations.

The firm should supply details to you with a paper called the Exclusive Positioning Memorandum (PPM) that offers a much more comprehensive description of expenditures and dangers connected with joining the investment. Rate of interests in these bargains are only used to individuals who certify as Accredited Investors under the Stocks Act, and a as specified in Area 2(a)( 51 )(A) under the Company Act or an eligible employee of the monitoring business.

There will certainly not be any type of public market for the Rate of interests.

Back in the 1990s and early 2000s, hedge funds were known for their market-beating performances. Some have underperformed, especially throughout the economic situation of 2007-2008, nonetheless. This different investing approach has a special means of operating. Usually, the manager of a financial investment fund will certainly reserve a portion of their readily available possessions for a hedged wager.

Who provides reliable High-yield Real Estate Investments For Accredited Investors options?

A fund supervisor for a cyclical sector may commit a part of the properties to supplies in a non-cyclical industry to offset the losses in situation the economic situation containers. Some hedge fund supervisors utilize riskier methods like making use of borrowed cash to purchase more of an asset merely to increase their prospective returns.

Similar to common funds, hedge funds are skillfully taken care of by career investors. Hedge funds can use to different investments like shorts, options, and by-products - Commercial Real Estate for Accredited Investors.

What is the difference between Accredited Investor Rental Property Investments and other investments?

You might choose one whose financial investment approach straightens with your own. Do keep in mind that these hedge fund money supervisors do not come economical. Hedge funds generally bill a cost of 1% to 2% of the properties, along with 20% of the revenues which functions as a "performance cost".

High-yield financial investments draw in numerous investors for their capital. You can acquire an asset and obtain compensated for keeping it. Recognized financiers have much more possibilities than retail financiers with high-yield financial investments and past. A higher variety provides accredited financiers the chance to obtain higher returns than retail financiers. Approved financiers are not your average financiers.

Accredited Investor Real Estate Crowdfunding

You need to accomplish at least among the complying with specifications to come to be an accredited capitalist: You should have more than $1 million total assets, excluding your primary residence. Organization entities count as recognized capitalists if they have over $5 million in possessions under management. You must have a yearly revenue that goes beyond $200,000/ yr ($300,000/ yr for companions submitting together) You must be a licensed investment advisor or broker.

As an outcome, approved capitalists have extra experience and money to spread throughout properties. Most investors underperform the market, including recognized financiers.

In addition, capitalists can build equity with positive money flow and residential property recognition. Real estate properties require considerable maintenance, and a whole lot can go wrong if you do not have the best group.

How do I get started with Accredited Investor Commercial Real Estate Deals?

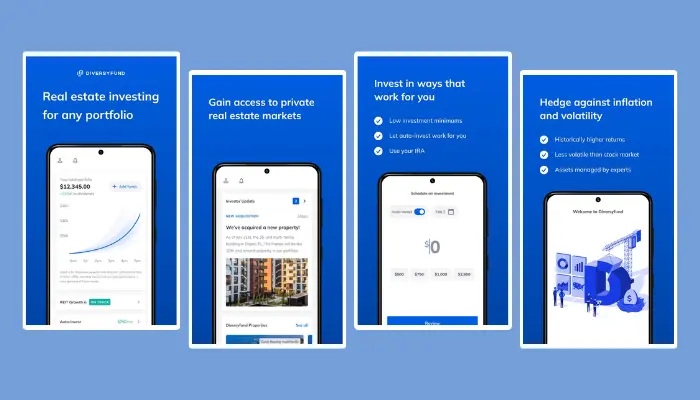

The sponsor locates financial investment opportunities and has a team in position to deal with every obligation for the home. Property syndicates merge cash from recognized capitalists to purchase properties lined up with well-known goals. Exclusive equity property lets you spend in a group of residential or commercial properties. Accredited financiers merge their money with each other to finance purchases and residential property growth.

Realty financial investment counts on must disperse 90% of their gross income to investors as rewards. You can acquire and sell REITs on the stock market, making them extra fluid than the majority of investments. REITs allow financiers to diversify swiftly throughout several residential or commercial property classes with extremely little resources. While REITs also turn you into a passive investor, you get more control over necessary choices if you join a genuine estate syndicate.

What does Accredited Investor Real Estate Income Opportunities entail?

Investors will certainly benefit if the stock cost increases given that exchangeable investments give them a lot more appealing access points. If the stock tumbles, investors can choose against the conversion and protect their finances.

Table of Contents

Latest Posts

Find Properties With Tax Liens

Tax Forfeited

Back Tax Homes For Sale

More

Latest Posts

Find Properties With Tax Liens

Tax Forfeited

Back Tax Homes For Sale