All Categories

Featured

Passion is just paid when a tax obligation lien is retrieved. Property becomes tax-defaulted land if the home taxes stay overdue at 12:01 a.m. on July 1st.

Home that has come to be tax-defaulted after 5 years( or three years when it comes to building that is additionally based on a nuisance abatement lien)ends up being subject to the county tax obligation collection agency's power to offer in order to satisfy the defaulted residential property taxes. The county tax collection agency might use the residential property to buy at public auction, a sealed quote sale, or a negotiated sale to a public firm or certified nonprofit organization. Public auctions are one of the most usual means of selling tax-defaulted residential property. The auction is performed by the area tax enthusiast, and the residential or commercial property is marketed to the highest prospective buyer. You're wondering concerning purchasing tax liens in Texas? It seems like a relatively reduced cost since you're paying any type of liens against the residential or commercial property rather

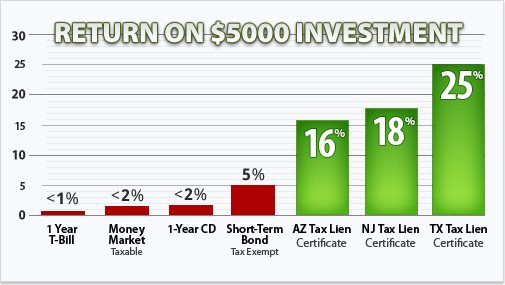

of buying the home itself. It can't be that simple, can it? Yes And no. Acquiring tax liens in Texas isn't ideal for brand-new capitalists because it's a challenging process that could cost you a fair bit if you aren't mindful. Texas doesn't market the lien itself. The state markets homes that are tax-delinquent at auction. The building's proprietor can redeem their building within a redemption period, however they'll deal with a 25% to 50%penalty. As the lienholder, you'll obtain the 25%to 50%fine the initial proprietor has to pay to obtain their home back in addition to any kind of prices you paid to get that property. If the building proprietor does not pay the owed tax obligations, the investor deserves to take the action to the home within a redemption period.

Texas Tax Lien Investing

Once a building has a tax obligation

How To Do Tax Lien Investing

lien certificate placed against positioned, the certificate will be will certainly off to the highest bidderGreatest Another advantage of investing in tax liens is that you can quickly calculate the rate of return - tax lien tax deed investing. There's a whole lot to be acquired when investing in tax liens, the threats should not be glossed over.

Allow's say you bought a tax lien for $20,000. If you like the location the home is located in, you can certainly maintain the residential or commercial property and utilize it as a second home.

Considering that residential or commercial property tax liens are a higher top priority than all various other liens, the home mortgage is wiped away if the residential property is bought via tax repossession sale. Tax deeds function a lot like tax obligation liens when residential property taxes are in arrearswith one vital exemption: the government or district takes immediate possession of property. Both tax obligation liens and tax obligation deeds are consequences property owners should face when building tax obligations go unpaid.

Latest Posts

Find Properties With Tax Liens

Tax Forfeited

Back Tax Homes For Sale